The Collapse of FTX (And Crypto?)

- DocRounds Biz

- Nov 11, 2022

- 7 min read

Market Update - 11/11/2022

I planned on writing about the full blown recession coming in 12-18 months. The fact that jobs will be lost. Bonuses will be cut. Retirement accounts will be decimated. How the government will be blamed and there’s going to be calls for a red wave to “fix” the economy. At which point we’ll miraculously see an economic turnaround right in time for the 2024 presidential election.

I’ll touch on that boring stuff at the end. For now, one crypto company just caused another $32 billion company to collapse.

Crypto

Holy Shit. One shark just ate another shark.

The company who put their name on the Miami Heat arena, Formula 1 race cars, and even MLB umpires are no more. From a $32 billion valuation at the beginning of the year, to bankruptcy in November. Goodbye FTX. This is the story of the worst day in crypto.

BACKGROUND

When you buy stock or crypto you usually hold it at an exchange. Some weirdos (geniuses?) still request paper certificates for stock. Serious crypto-bros move their crypto to a personal wallet. But most people keep their assets at an exchange like Fidelity or Coinbase.

STORY

In crypto, 2 of the big offshore exchanges are Binance and FTX. They each hold billions of dollars worth of people’s crypto deposits. Binance just pulled an old school mafia move and buried FTX with the fishes. With 1 tweet they crashed the value of FTX, put them on the brink of bankruptcy, and then offered to buy the billion dollar company for essentially nothing. And that’s only the beginning.

The entire process played out in 48 hours - and also crashed the entire crypto industry at large.. Crypto enthusiasts say it's the worst day in crypto history. The whole thing started when Binance CEO tweeted they would sell their holdings of FTX’s token, FTT.

The FTT token is used within the FTX exchange for small perks like bypassing fees. FTX printed the token like crazy, valued it at billions of dollars and used the token as collateral in many deals. They basically traded magic beans for real dollars and crypto.

The tweet caused an 8% drop and triggered a further sell off of the token. Even worse, the loss of confidence started to bleed over to FTX the exchange. This led to an old fashioned run on the bank. Customers tried to liquidate $6 billion worth of crypto that FTX couldn’t cover (more on this below).

The Binance CEO must have sent that tweet knowing something wasn’t right at FTX. A few hours later both companies tweeted out that Binance would purchase FTX and cover the liquidity crunch.

For a moment it seemed like Binance had found a way to purchase FTX and all their assets for nothing! They would simply provide a bridge loan to cover customer withdrawals. Even if that cost them $6bn, if FTX has $16bn in assets, they come out $10bn ahead. Billion dollar chess.

But alas that last line… “pending DD etc”. Pending due diligence.

Well, guess what happened?

Deal off. Customer withdrawals stopped. FTX declares bankruptcy. Damn.

HACKERS

Just when I thought the story couldn’t get any crazier, 2 days later on Friday night, whatever funds were left at FTX started to flow out of their public wallet. FTX’s attorney tweeted they didn’t know why there was movement. A few hours later an admin posted on their Discord channel that it was in fact a hack. Any chance of getting money out seem to be long gone.

DETAILS EMERGE

There’s going to be legal ramifications for what FTX was doing. Where are the client funds? Why were they allowed to print their own money? How could their owner be worth $16 billion in a relatively tiny industry?

What seemed like a heartwarming story of a corporate takeover is quickly turning into one of the largest cases of fraud and investor loss in history.

SAM BANKMAN - (FRAUD) FRIED

FTX is run by Sam Bankman-Fried, known as SBF. Estimated to be worth $16 billion, the media darling and second largest donor to the Democratic party has been characterized as the next everybody… Warren Buffet, JP Morgan, Steve Jobs. “Adorably autistic”, he sleeps on a beanbag, plays League of Legends and only wants money so he can give it away.

Well it turns out he also uses billions in other people's money to fund his lifestyle and other failed projects.

HOW TO STEAL BILLIONS

Sam Bankman-Fraud-Fried tweeted out a lot of B.S. and a cryptic hat tip to Binance for the power move.

There’s no winners here scumbag.

The truth is he did a bunch of shady stuff. Including using client deposits to cover another failing company he owns called Alameda Research. Alameda Research is a trading firm that makes money trading cryptocurrency. One of their biggest holdings? FTT token of course.

Here’s how you lose $16 billion:

SBF created Company A (FTX) which created a fake currency (FTT) and then used Company B (Alameda) to buy a bunch of that fake currency.

Since Company B (Alameda) were early investors, they got that currency for dirt cheap. As the value of Company A (FTX) increased, so did the value of the fake currency and the value of Company B’s (Alameda’s) portfolio.

Fast forward to this week and Company B is in trouble. So what does SBF do? Since Company B (Alameda) owned all that juicy fake currency, he used it as collateral to transfer $4 billion from Company A (FTX) to keep Company B (Alameda) running.

So Company A (FTX) created a fake currency (FTT) and Company B (Alameda) bought a bunch of that currency. Company B then transferred that fake currency back to Company A as collateral for customer deposits ($).

The value of the fake currency collapsed, Company A is holding worthless collateral and no longer has that $4 bn.

Also, last summer a lot of stuff in crypto failed. Company B (Alameda) had exposure to a lot of those crypto projects and suffered huge losses. So what did S-B-Fraud do?

He used Company A (FTX) to “invest” in those companies, thereby saving the investments of Company B. Presumably using client deposits.

Company A (FTX) also loved marketing and spent hundreds of millions on campaigns and commercials. Presumably using client deposits.

Hackers take what is remaining.

FTT is worthless. FTX is worthless. $16 billion of deposits from individuals, pension funds, endowments, mutual funds, hedge funds, venture capitalists, is gone. Not to mention the billions in loans that FTX and Alameda owe to other companies. Good luck in bankruptcy court.

HOW COULD THIS HAPPEN?

The U.S. Government is blaming the crypto industry. The crypto industry is blaming the U.S. government.

Brian Armstrong, CEO of Coinbase, argues that lack of clarity and regulation forced investors to inferior offshore alternatives.

The truth is investors got greedy. The emperor was naked and nobody said anything. There was no due diligence and they followed each other off a cliff. Venture Capitalists poured billions into FTX and really into S-B-Fraud even though FTX DIDN’T HAVE A BOARD OF DIRECTORS.

Professional investors gave complete control to a kid who allegedly played League of Legends during pitch meetings and couldn’t be bothered to properly tie his shoes when speaking in front of Congress.

MOVING FORWARD

At the end of the day, this collapse is a continuation of what happened this summer and the full effects will still take some time to flush through. Although SBF is American, he chose to take the company overseas to the Bahamas to circumvent regulation. I wouldn’t consider this an indictment on crypto as much as I would on human beings.

These are centralized exchanges, just like banks, handling billions in deposits, just like banks, but running wild in a regulation free zone. Crypto needs to either move to decentralized exchanges (with no customer support if you fuck up), or regulated central exchanges like Coinbase. The blockchain allows for “Proof of Reserves” to cryptographically prove assets and liabilities. This needs to be the standard.

This will leave crypto with a dark hole for funding and regulation. Investors will be gun shy to jump onto the next crypto project. At least in the short term. SBF was a huge donor to the Democratic party and was embraced by Washington. They made him out to be the golden child and he made fools of everyone. Those that were embarrassed won’t feel inclined to help the space and may possibly lean towards over regulation.

As these scam artists and grifters are exposed and jailed, we get closer to a usable ecosystem. The question is will there be any users left?

Investing

BIG TECH

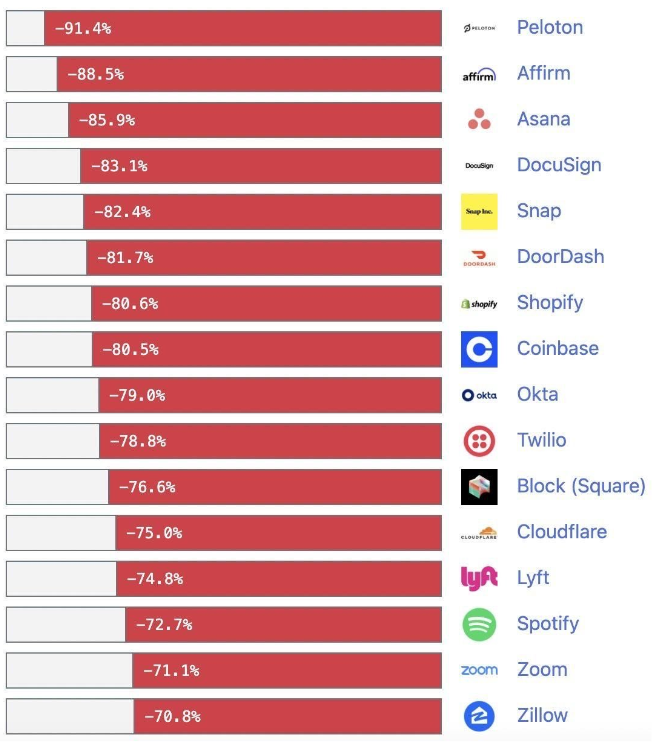

The Tech sector is doing its best 2001 impression with most companies down 50-90%! (From all time highs set during the pandemic). Up until this point it’s been a lot of the smaller companies feeling pain. We’re officially seeing the shock hit the blue bloods.

In a recession the ad market is a signal for the overall market. Advertising is the first to go and slow to bounce back. Facebook (Meta), Google, Twitter, Snap act like tech companies but are really advertising businesses.

We can expect the market bottom when these larger companies start showing weakness. Meta announced a 11% layoff, but that seems more related to investor anger over spending rather than fear to the core business.

THE FED

The Fed raised rates another 0.75% as they try to control inflation. We finally saw some inflation relief with the latest CPI figure (7.7% vs. expected 8.3%). This caused the largest 2 day gain in the market since 2008. Investors think this is a sign of recovery and that the Fed will slow future rate hikes. The Fed needs the economy to hit a wall to stop inflation or we’ll be looking at a worthless dollar. Big market bumps like this don’t help.

They already said they’re willing to take us into a deep recession to protect our currency. There are 2 big fears with the Fed plan:

The Fed pulls us into a recession to control the economy. But at the smallest sign of improvement the markets take off again which leads to more inflation.

The Fed has a habit of reacting slowly. If they're too slow reacting to the recession and leave rates too high for too long, it would be a multi-year recession instead of the normal 12 to 18 months. At that point they’ll have to lower rates and start the process of “easy” money again.

DID YOU KNOW Warren Buffet made 99% of his money after age 50 and 97% of his money after age 65. He was an unknown rich guy in the 90s who just never retired and let it ride.

Comments